Changes to Rules on Eligible Deductions for Short-Term Rental Properties: What you Need to Know

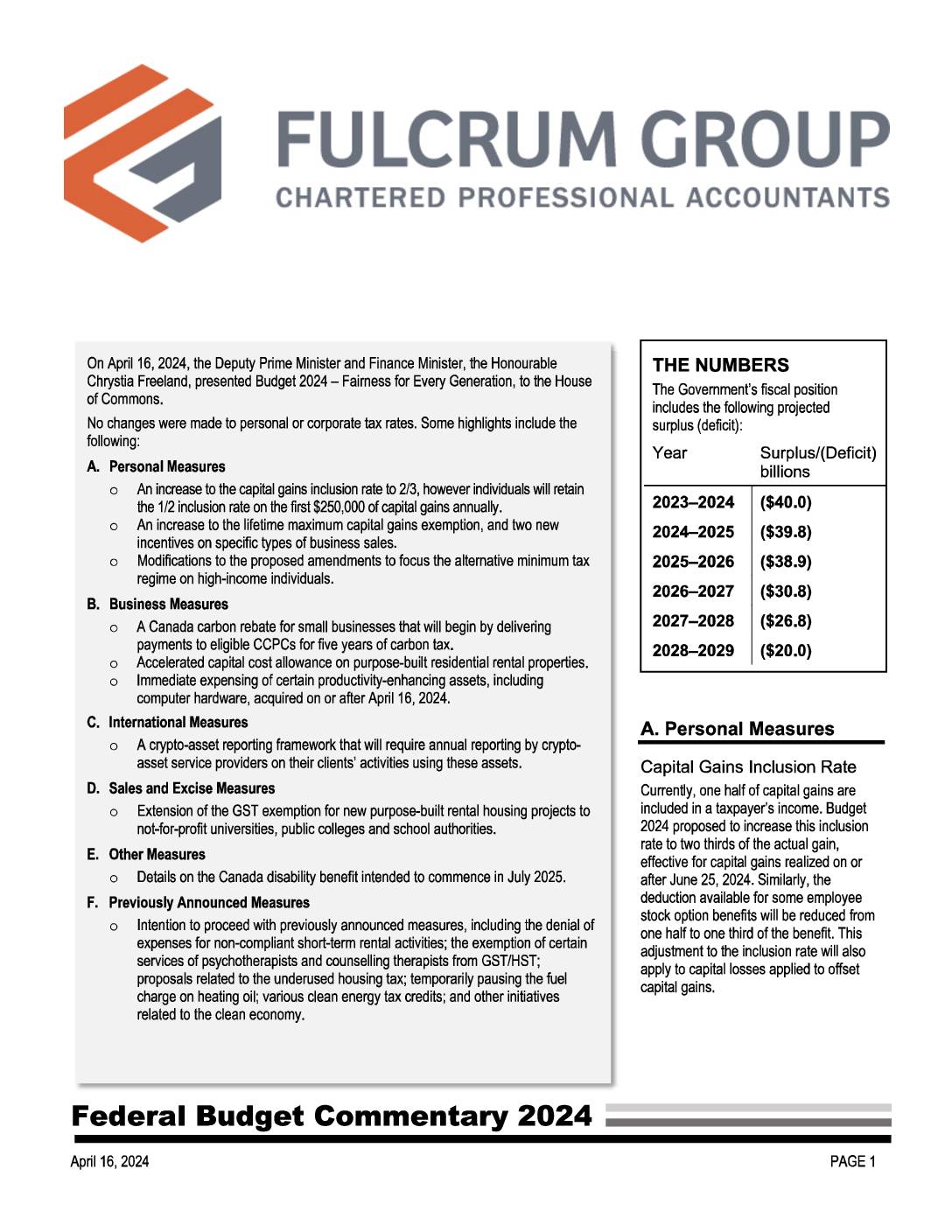

The Canada Revenue Agency (CRA) has introduced significant changes to the rules for eligible deductions from short-term rental income, effective for tax years after 2023. These changes primarily affect non-compliant short-term rentals and aim to ensure proper regulation and taxation of this growing sector (source: https://www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax-tips-2025/changes-rules-eligible-deductions-short-term-rental-income.html).

Effective January 1, 2024, expense deductions for short-term rentals (as defined below) will be denied if the property is deemed non-compliant.

What qualifies as a short-term rental?

According to the CRA, a short-term rental is defined as a residential property that is rented or offered for rent for a period of less than 90 consecutive days. This definition applies to various types of residential properties, including houses, apartments, condominium units, cottages, mobile homes, trailers, and houseboats located in Canada (source: https://www.cpacanada.ca/business-and-accounting-resources/taxation/blog/2024/february/non-compliant-short-term-rentals).

It’s important to note that some municipalities may have their own specific definitions for short-term rentals:

- In Alberta, a short-term rental is a residential property rented or offered for rent for less than 90 consecutive days.

- In Calgary as of April 1, 2025, short-term rentals will include stays up to 180 consecutive days.

Generally, rentals that are leased to a single tenant for 31 consecutive days or more are not considered short-term rentals. The CRA’s definition of less than 90 consecutive days is the primary federal standard for tax purposes, but local regulations may impose additional requirements or restrictions on short-term rental operations.

Changes to the rules for eligible deductions

The following tax rules surrounding short-term rentals are effective January 1, 2024:

- Definition of short-term rental: A residential property rented or offered for rent for less than 90 consecutive days.

- Non-compliant short-term rentals: Properties that either operate in locations where short-term rentals are prohibited or fail to comply with provincial or municipal registration, licensing, and permit requirements.

- Expense deduction restrictions: The new rules deny income tax deductions for expenses related to non-compliant short-term rentals. This includes costs such as mortgage interest, property taxes, insurance, repairs, and maintenance. For a full list of rental expenses you can deduct, refer to CRA’s website here (source: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/rental-income/completing-form-t776-statement-real-estate-rentals/rental-expenses-you-deduct.html)

- Non-compliant amount calculation: For partially non-compliant rentals, deductions are prorated based on the number of non-compliant days using the formula: A × B ÷ C, where:

- A = the total deductible expenses

- B = the number of non-compliant days, and

- C = the total rental days in the tax year.

- Transition relief for 2024: Property owners had until December 31, 2024, to ensure compliance with all local licensing, registration, and permit requirements. If compliant by this date, they will be deemed compliant for the entire 2024 tax year and can deduct eligible expenses.

- Increased tax liability: Non-compliant rentals may face a substantial increase in taxable income due to the inability to deduct expenses.

- Record-keeping requirements: Taxpayers must maintain accurate records to report rental income and claim eligible expenses, including documentation confirming compliance with local regulations.

These new rules apply to individuals, corporations, and trusts operating short-term rental properties. Property owners are advised to familiarize themselves with these regulations to avoid potential tax implications and penalties for non-compliance.

How can I apply for transitional relief?

To apply for transitional relief for your short-term rental property, you don’t need to submit a specific application. Instead, you need to ensure your property is compliant with all applicable provincial or municipal registration, licensing, and permit requirements by December 31, 2024. Here are the steps to take:

- Research local regulations: Understand the specific short-term rental laws in your municipality or province.

- Obtain necessary licenses and permits: Apply for and secure all required licenses, registrations, or permits to operate your short-term rental legally.

- Maintain compliance: Ensure your property meets all local requirements, such as zoning laws, safety standards, and operational guidelines.

- Keep thorough records: Maintain detailed documentation of your compliance efforts, including copies of all registrations, licenses, and municipal correspondence.

- Continue normal tax reporting: Report your rental income and expenses as usual on your tax return for 2024.

If you meet all compliance requirements by December 31, 2024, your short-term rental will be deemed compliant for the entire 2024 tax year, allowing you to deduct eligible expenses for the full year. This transitional relief applies to individuals, corporations, and partnerships for the 2024 tax year only.

Remember, while no formal application is required, it’s crucial to act promptly to ensure compliance before the deadline. Consulting with a tax professional can help you navigate this process effectively.

Conclusion

The recent changes to eligible deductions for short-term rental properties in Alberta represent a significant shift in the taxation landscape for property owners. The denial of expense deductions for non-compliant rentals introduces the potential for substantially increased tax liabilities and can directly impact the profitability of these rental properties.

While the transitional relief period in 2024 offers a window of opportunity for owners to achieve compliance and retain full deductions, the onus is now firmly on property owners to ensure they meet all local regulations and maintain thorough records.

If you have any questions regarding these changes and how they can impact your corporate or personal tax returns, please contact our office.